Section 179 details

Section 179 at a Glance for 2015 (updated for the PATH Act of 2015)

2015 Deduction Limit = $500,000

This deduction is good on new and used equipment, as well as off-the-shelf software. This limit is only good for 2015, and the equipment must be financed/purchased and put into service by the end of the day, 12/31/2015.

This deduction is good on new and used equipment, as well as off-the-shelf software. This limit is only good for 2015, and the equipment must be financed/purchased and put into service by the end of the day, 12/31/2015.

2015 Spending Cap on equipment purchases = $2,000,000

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. This spending cap makes Section 179 a true "small business tax incentive".

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. This spending cap makes Section 179 a true "small business tax incentive".

Bonus Depreciation: 50% for 2015

Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. Note: Bonus Depreciation is available for new equipment only.

Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. Note: Bonus Depreciation is available for new equipment only.

The above is an overall, "simplified" view of the Section 179 Deduction for 2015. For more details on limits and qualifying equipment, as well as Section 179 Qualified Financing, please read this entire website carefully. We will also make sure to update this page if the limits change.

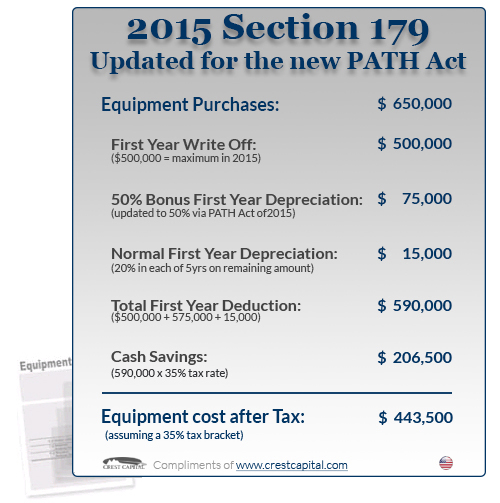

Here is an updated example of Section 179 at work during this 2015 tax year after the recent passage of the PATH Act of 2015:

What is the Section 179 Deduction?

Most people think the Section 179 deduction is some mysterious or complicated tax code. It really isn't, as you will see below.

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It's an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Several years ago, Section 179 was often referred to as the "SUV Tax Loophole" or the "Hummer Deduction" because many businesses have used this tax code to write-off the purchase of qualifying vehicles at the time (like SUV's and Hummers). But, that particular benefit of Section 179 has been severely reduced in recent years, see 'Vehicles & Section 179' for current limits on business vehicles.

Today, Section 179 is one of the few incentives included in any of the recent Stimulus Bills that actually helps small businesses. Although large businesses also benefit from Section 179 or Bonus Depreciation, the original target of this legislation was much needed tax relief for small businesses - and millions of small businesses are actually taking action and getting real benefits.

Essentially, Section 179 works like this:

When your business buys certain items of equipment, it typically gets to write them off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example).

Now, while it's true that this is better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

In fact, if a business could write off the entire amount, they might add more equipment this year instead of waiting over the next few years. That's the whole purpose behind Section 179 - to motivate the American economy (and your business) to move in a positive direction. For most small businesses, the entire cost can be written-off on the 2015 tax return (up to $500,000).

Limits of Section 179

Section 179 does come with limits - there are caps to the total amount written off ($500,000 for 2015), and limits to the total amount of the equipment purchased ($2,000,000 in 2015). The deduction begins to phase out dollar-for-dollar after $2,000,000 is spent by a given business, so this makes it a true small and medium-sized business deduction.

Who Qualifies for Section 179?

All businesses that purchase, finance, and/or lease less than $2,000,000 in new or used business equipment during tax year 2015 should qualify for the Section 179 Deduction.

Most tangible goods including "off-the-shelf" software and business-use vehicles (restrictions apply) qualify for the Section 179 Deduction. For basic guidelines on what property is covered under the Section 179 tax code, please refer to this list of qualifying equipment. Also, to qualify for the Section 179 Deduction, the equipment and/or software purchased or financed must be placed into service between January 1, 2015 and December 31, 2015.

The deduction begins to phase out if more than $2,000,000 of equipment is purchased - in fact, the deduction decreases on a dollar for dollar scale after that, making Section 179 a deduction specifically for small and medium-sized businesses.

What's the difference between Section 179 and Bonus Depreciation?

Bonus depreciation is offered some years, and some years it isn't. Right now in 2015, it's being offered at 50%.

The most important difference is both new and used equipment qualify for the Section 179 Deduction (as long as the used equipment is "new to you"), while Bonus Depreciation covers new equipment only.

Bonus Depreciation is useful to very large businesses spending more than the Section 179 Spending Cap (currently $2,000,000) on new capital equipment. Also, businesses with a net loss are still qualified to deduct some of the cost of new equipment and carry-forward the loss.

When applying these provisions, Section 179 is generally taken first, followed by Bonus Depreciation - unless the business had no taxable profit, because the unprofitable business is allowed to carry the loss forward to future years.

Leasehold Improvements, Restaraunt and Retail property

You can elect to treat certain qualified real property you placed in service as section 179 property for tax years tax years beginning before 2015. If this election is made, the term “section 179 property” will include any qualified real property that is:

The maximum section 179 expense deduction that can be elected for qualified section 179 real property is $250,000 of the maximum section 179 deduction of $500,000 for tax years beginning in 2014. For more information, see Special rules for qualified section 179 real property, later. Also, see Election for certain qualified section 179 real property, later, for information on how to make this election.

You can elect to treat certain qualified real property you placed in service as section 179 property for tax years tax years beginning before 2015. If this election is made, the term “section 179 property” will include any qualified real property that is:

- Qualified leasehold improvement property,

- Qualified restaurant property, or

- Qualified retail improvement property.

Qualified leasehold improvement property. Generally, this is any improvement (placed in service before January 1, 2015) to an interior portion of a building that is nonresidential real property, provided all of the requirements discussed in chapter 3 under Qualified leasehold improvement property are met.

In addition, an improvement made by the lessor does not qualify as qualified leasehold improvement property to any subsequent owner unless it is acquired from the original lessor by reason of the lessor’s death or in any of the following types of transactions.

- A transaction to which section 381(a) applies,

- A mere change in the form of conducting the trade or business so long as the property is retained in the trade or business as qualified leasehold improvement property and the taxpayer retains a substantial interest in the trade or business,

- A like-kind exchange, involuntary conversion, or re-acquisition of real property to the extent that the basis in the property represents the carryover basis, or

- Certain nonrecognition transactions to the extent that your basis in the property is determined by reference to the transferor’s or distributor’s basis in the property. Examples include the following.

- A complete liquidation of a subsidiary.

- A transfer to a corporation controlled by the transferor.

- An exchange of property by a corporation solely for stock or securities in another corporation in a reorganization.

Qualified restaurant property. Qualified restaurant property is any section 1250 property that is a building or an improvement to a building placed in service after December 31, 2008, and before January 1, 2015. Also, more than 50% of the building’s square footage must be devoted to preparation of meals and seating for on-premise consumption of prepared meals.

Qualified restaurant property. Qualified restaurant property is any section 1250 property that is a building or an improvement to a building placed in service after December 31, 2008, and before January 1, 2015. Also, more than 50% of the building’s square footage must be devoted to preparation of meals and seating for on-premise consumption of prepared meals.

Section 179's "More Than 50 Percent Business-Use" Requirement

The equipment, vehicle(s), and/or software must be used for business purposes more than 50% of the time to qualify for the Section 179 Deduction. Simply multiply the cost of the equipment, vehicle(s), and/or software by the percentage of business-use to arrive at the monetary amount eligible for Section 179.

Thanks to the Section179.org group for delivering this information so concisely!

<< Home